How Much Money Do you Need to Justify a Testamentary Trust?

There’s a common misconception that testamentary discretionary trusts (referred to as testamentary trusts in this post, for ease) are only for the ultra wealthy.

I want to break down this misconception, as I personally believe that testamentary trusts can be life-changing for everyday families.

Not every client will benefit from a testamentary trust in their will, but the number of families who will benefit from a testamentary trust is higher than you might think.

So when should a testamentary trust be considered for a willmaker?

Would a Testamentary Trust be useful?

Consider Testamentary Trust If:

☑ There will be investable assets of at least $500,000 (including super and life insurance) after administration of the estate

☑ There are minors who can receive approximately $22,000 tax free income each year from investing the inheritance

☑ It is important to protect the inheritance from relationship or bankruptcy risks

☑ A beneficiary cannot be trusted to manage their inheritance appropriately

What is the minimum asset value to warrant a Testamentary Trust?

Firstly, it’s important to know that there is no legislation or case law that sets the minimum asset value to warrant a testamentary trust.

Without legislation or case law to refer to, what is our guidepost for determining when to bring up the testamentary trust option when meeting with a client?

Prefer to listen instead? Check out Episode #8 of The Art of Estate Planning Podcast, where we delve deeper into how much money is needed to warrant a testamentary trust.

Rule of thumb

My threshold recommendation is that it is worth considering a testamentary trust if the trust will receive around $500,000 of investible assets after administration of the estate.

These assets include financial resources that can easily be converted into cash and invested to generate an income, such as shares, managed funds, income generating property, life insurance proceeds or superannuation death benefits. Generally speaking, an assets that will be used to generate income (for example, contrast this with a family home which might be valued at more than $500,000 but will not generate income while the family is using it as their principal place of residence).

This is a very general rule of thumb, primarily designed so that the tax free income benefits for minors can be accessed in the testamentary trust. If the main reason for considering a testamentary trust is actually the asset protection benefits, then a client may consider a testamentary trust to be valuable for their family even if the asset pool is less than $500,000

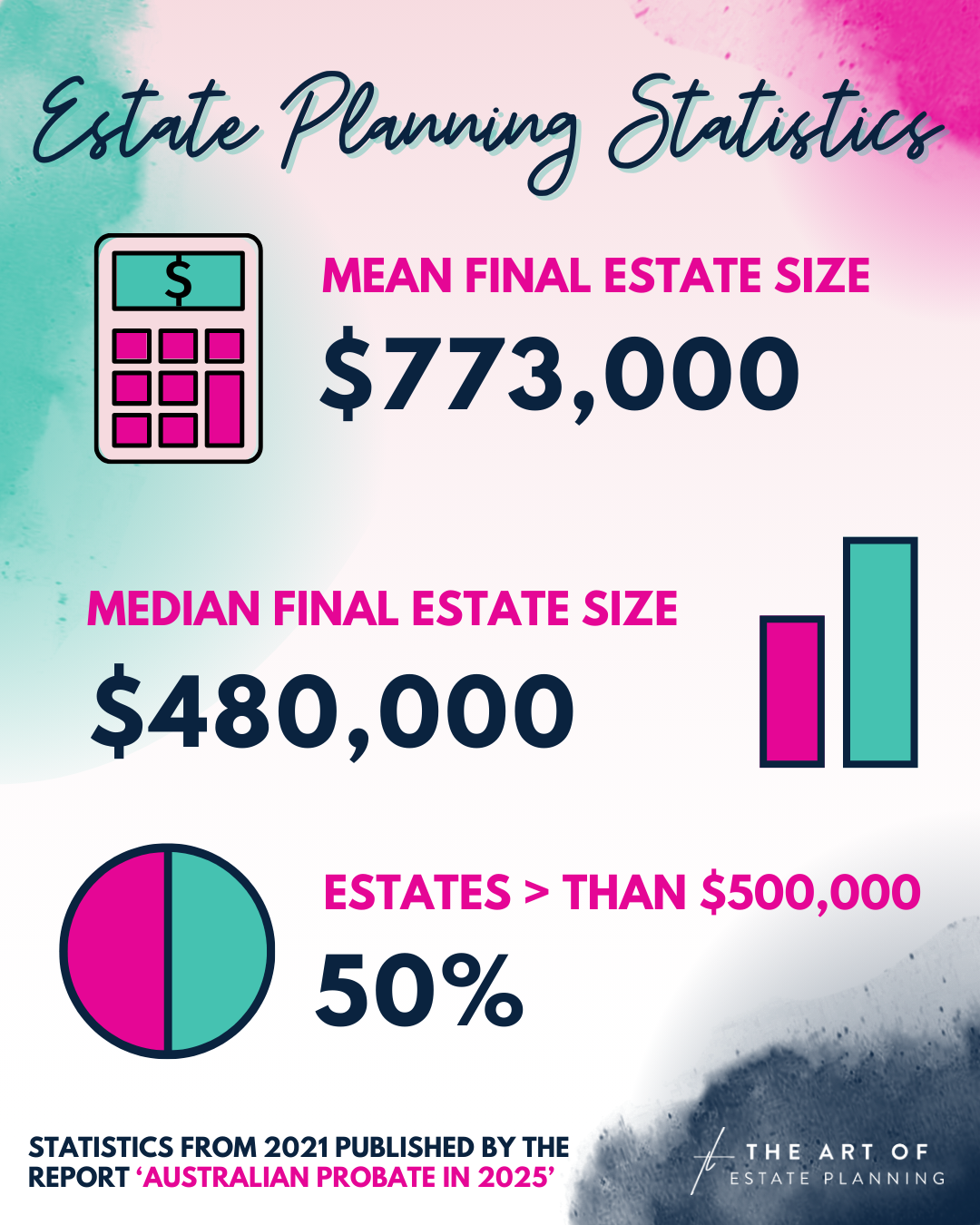

While $500,000 of investible assets might seem to be a high bar, you might be surprised to know that in 2014, the mean size of estates in Victoria according to the Grattan Institute was $773,000 and more than 50% of estates were larger than $500,000.

Why does a testamentary trust need a minimum value of assets?

If a beneficiary under an estate uses the inheritance to immediately pay off their mortgage, buy a new car, and treat the family to a trip to Disneyland, with no income producing assets remaining, then they are unlikely to have inherited any assets which can reap the benefits of a testamentary trust. While the ongoing compliance of a testamentary trust is not significant, if there are no direct benefits from the testamentary trust then the compliance will outweigh its value.

In my personal situation (I only refer to myself to protect client confidentiality), we already have three family trusts, so establishing one more trust is not a significant burden. We already have an accountant handling the trust tax returns and are fully familiar with the ongoing compliance obligations of a trust. It's essentially just one more trust to manage in our family group, with the significant tax and asset protection benefits more than outweighing the compliance responsibility.

Want to find out exactly what compliance is involved

in setting up and maintaining a TDT?

This returns us to the fundamental question: What are the benefits of a testamentary trust?

Here are three key advantages of having a testamentary trust:

1. Tax Free Income Treatment for Minors

There is no other vehicle under the Australian tax regime which receives tax benefits comparable to a testamentary trust. Because a testamentary trust can only be established after a person has died, the testamentary trust is given concessional tax treatment which cannot be replicated with a family trust or company during a person’s life time.

While testamentary trusts offer income tax streaming benefits similar to an inter vivos discretionary trust (i.e. a family trust established during a person’s lifetime), the key difference is that beneficiaries of a testamentary trust who are minors can each receive $22,550 of tax-free income from the trust each year (this figure can vary depending on tax rates and offsets, but is correct at the date of publication). Any income in excess of $22,550 then taxed at the standard adult marginal tax rates.

And this extends to any minor beneficiaries for the life of the trust - children, grandchildren, great-grandchildren, nieces, nephews, etc.

For example, if the willmaker has two minor children and gifts their inheritance into a testamentary trust, this allows for the distribution of up to approximately $45,000 of tax-free income that the trust earns from investing the inheritance; with three minor children, this rises to around $67,000. These savings repeat each year over the life of the trust while there are minor beneficiaries. For instance, when the willmaker’s children become adults and have children of their own, they can then distribute tax free income to their children (i.e. the willmaker’s grandchildren). And so on for multiple generations over the life of the trust.

These figures represent substantial tax savings for Australian families who utilise testamentary trusts, resulting in families paying significantly less tax than they otherwise would have, compared to if the willmaker had used a basic will and gifted the assets directly to their spouse.

Want to learn more about how excepted trust income treatment works for testamentary trusts? Check out episode #45 of The Art of Estate Planning Podcast.

The tax benefits of a testamentary trust are irrelevant if the trust does not have sufficient assets to generate an income.

2. Asset Protection

A testamentary trust can assist with asset protection, segregating the inheritance in the event there is a claim in bankruptcy or family law against one of the beneficiaries of the trust.

3. Protection for Minors

We have all heard stories of children who are financially immature, and, upon gaining access to their inheritance, make ill-considered and short-term financial decisions that erode their inheritance. It's a classic trope.

A testamentary trust sets minor beneficiaries up for success, not failure, by allowing the will maker to nominate trusted family members and friends to manage the inheritance in the testamentary trust until the children are ready to take on the responsibility, essentially protecting them from wasting their inheritance due to immature financial decision-making.

Even if clients have had no prior exposure to family trusts or testamentary trusts, I recommend presenting a testamentary trust as a possible estate planning option if their investable assets fall roughly within the $500,000 threshold.

Providing clients with information explaining how the testamentary trust would work and ensuring they have sufficient details to make an informed choice, allows the client to make an informed decision about whether they believe the testamentary trust would be beneficial for their family.

Testamentary Trusts: The Essential Guide for Australian Lawyers

In the estate planning space, testamentary trusts have reputationally been regarded as super complex. I am on a personal mission to change that perception and to support lawyers who want to gain confidence with testamentary trusts, so they can better serve their clients.

Here at The Art of Estate Planning, we have an online course called “Testamentary Trusts: The Essential Guide for Australian Lawyers”. This online course will deepen your understanding of testamentary trusts. Whether you're starting out, switching specialties, or refining your skills, this 10-hour self-paced course will enhance your confidence and expertise when working with testamentary trusts.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.