How Testamentary Trusts Offer Tax-Free Income to Minors

The tax-free income for minors is one of the most powerful benefits of a testamentary discretionary trust. How does it work?

Many of our estate planning clients will not be from a tax background or have any kind of interest in tax other than paying as little of it as possible. It is a challenge for estate planning lawyers to be able to communicate the tax outcomes and benefits for their estate plan in a way that clients can easily comprehend without feeling overwhelmed. However, if you can successfully help clients to appreciate the income tax advantages of testamentary trusts, then it will be rich in rewards.

Prefer to listen instead? Check out Episode #45 of The Art of Estate Planning Podcast, where I discuss for non-tax lawyers the tax-free income treatment for minor beneficiaries of testamentary discretionary trusts.

Company vs. Testamentary Trust

When considering how discretionary trusts (including family trusts and testamentary discretionary trusts) are taxed, it can be useful to consider the different tax treatment between a company and a trust, as many of us are more familiar with how a company is taxed.

A company earns income from its activities, pays tax on the income at the applicable company rate of tax, and the remaining income can be retained in the company for future expenditure or distributed to the company’s shareholders via franked dividends.

In contrast, a discretionary trust (including a testamentary discretionary trust) is a flow-through vehicle for tax purposes.

Before June 30 every year, the trustee of the trust must resolve to allocate all of the net income the trust has earned for that financial year among the beneficiaries. As the trust is discretionary, the trustee has complete discretion about who among the beneficiaries may receive an income distribution, provided the trustee has given real and genuine consideration to the needs of all the beneficiaries and followed the powers set out in the trust deed.

The beneficiaries who receive a distribution from the trust at the election of the testamentary trust trustee then report that income in their personal annual tax return as part of their taxable income, and pay tax on that income at their particular marginal rate, factoring in their total taxable income for that year.

General Tax Rules for Minors

The general position is that if a child receives income from a trust, the child can only receive $416 tax-free. Unearned income received by the child between $417 and $1,307 is taxed at a rate of 66%, and income in excess of $1,307 is taxed at 45%. As a result, there is a strong disincentive to distribute more than $416 from a family trust (i.e. a discretionary trust established during a person’s lifetime) to children.

Advantageous Tax Treatment for Minors in Testamentary Trusts

One of the key advantages of a testamentary discretionary trust is that minor beneficiaries can avoid paying high penalty tax rates on income distributions.

In particular, distributions from a testamentary discretionary trust to the minor beneficiaries of the trust will be treated as “excepted trust income” under Section 102 AG of the Income Tax Assessment Act 1936.

Section 102 AG(2)(a) of the Income Tax Assessment Act 1936 (Cth) essentially says that income of a trust will be “excepted trust income" to the extent that the amount of income resulted from a will or an order of a court that varied or modified the provisions of a will. In short, the trust must have been created as a result of a person’s death.

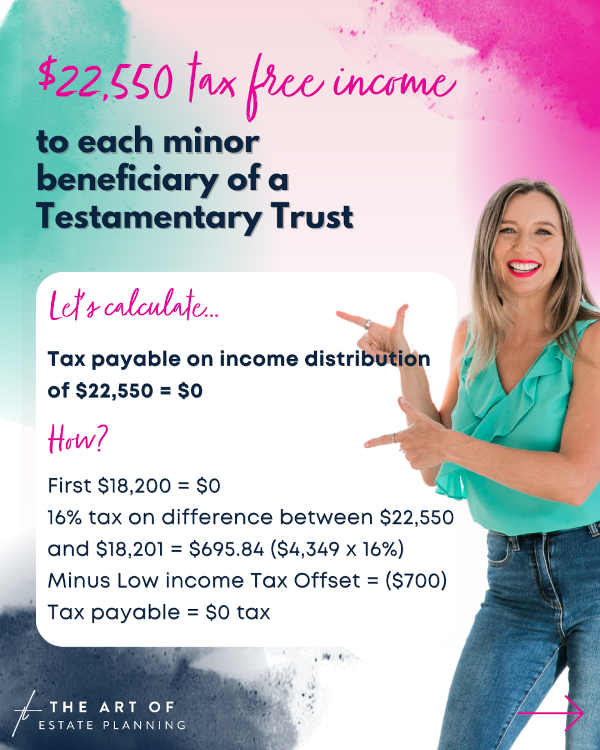

In practice, this means that a minor beneficiary will be taxed as an adult on any distributions from a testamentary discretionary trust. In practical terms, this means that each resident minor beneficiary of a testamentary discretionary trust can receive (at the date of publication) $22,550 (when you combine the effects of the tax-free threshold of $18,200 and the low income tax offset of $700 at the date of writing) tax-free each year, with adult marginal tax rates applying thereafter.

Common Questions

Tax Treatment for Minors of a Fixed Testamentary Trust

How is the income taxed for minor beneficiaries of a fixed or bare testamentary trust?

Even if the will does not proactively establish a testamentary discretionary trust, if a minor is the recipient of an inheritance, it must be held on trust for them until they turn 18. As a result, the will establishes a fixed or bare testamentary trust where there is a single beneficiary (i.e. the minor gift recipient).

Because the test in Section 102AG(2)(a) simply requires that the income resulted from a will, this means that even income earned by minor beneficiaries under a bare or fixed trust arrangement would be eligible for excepted income treatment (i.e. the minor beneficiary does not pay penalty tax rates and is instead taxed as an adult). However, the excepted income treatment becomes irrelevant once the minor becomes an adult. The beneficiary does not then have the opportunity to make tax-free distributions to their own children or grandchildren. There will be no ability to stream income or preserve access to excepted trust income treatment through multiple generations.

In contrast, a testamentary discretionary trust creates the ability to stream income to multiple generations of minor beneficiaries over the life of the trust, compounding the tax savings over its lifetime.

Why are testamentary trusts given this special tax treatment?

Testamentary discretionary trusts are the only structure in the Australian tax system that allows you to allocate tax-free amounts to children and tax children at adult marginal tax rates.

A testamentary discretionary trust can only exist because a person has died. In essence, our taxation regime recognises that there was a family tragedy behind this structure and has created a tax environment that is designed to support families who have lost an income earner.

It is time for everyday Australians to understand the benefits of including a testamentary discretionary trust in their will. Testamentary trusts keep wealthy families wealthy, but they also give everyday Australians a fair go.

Does the minor have to be a child of the testator?

It is important to note that the minor beneficiary does not require any particular relationship or connection with the testator. This means that the excepted tax income concessional tax treatment is available for all minor beneficiaries of the trust – whether they be children, grandchildren, nieces, nephews, godchildren or beloved friends. Any minor over the lifetime of the testamentary discretionary trust is eligible to receive the tax-free treatment, provided they are a beneficiary of the trust, and the trustee exercises its discretion to distribute income to that beneficiary.

Can a family set up a testamentary discretionary trust after someone has died?

Another critical point to note is that the testamentary discretionary trust must have been established under the deceased’s will – the opportunity to access this tax treatment is lost if a person dies without a testamentary trust in their will. So, if there is any doubt about whether a testamentary discretionary trust would be beneficial, it is best to err on the side of caution and include the possibility of a testamentary discretionary trust in the will.

Can income be retained or accumulated in a testamentary discretionary trust?

Usually, income cannot be accumulated or retained in a discretionary trust without paying penalty tax rates. Where the trustee resolves to accumulate income (or the default provisions in a trust deed operate to accumulate trust income), the trustee will be typically assessed under Section 99A of the Income Tax Assessment Act 1936 (Cth) at the top marginal rate on that income.

However, testamentary discretionary trusts are also eligible for concessional tax treatment on income accumulation.

Section 99A(2) of the Income Tax Assessment Act 1936 (Cth) provides that Section 99A will not apply to a trust that resulted from a will, a codicil or an order of a court that varied or modified the provisions of a will or a codicil, if the Commissioner is of the opinion that it would be unreasonable for Section 99A to apply.

If the Commissioner exercises its discretion, then the testamentary discretionary trust’s undistributed income will be taxed at concessional rates in accordance with Section 99 (i.e. taxed at an adult resident taxpayer’s marginal rates (excluding the tax-free threshold of $18,200).

When determining whether to exercise its discretion, the Commissioner is directed by Subsection 99A(3) to have regard to the following matters:

1. The source of the trust capital, including whether any loans have been made to the trust and the manner and price at which the trust acquired its assets,

2. Whether any special rights or privileges are attached to, or conferred on or in relation to, the trust property, and

3. Such other matters as the Commissioner thinks fit.

In Private Ruling Authorisation Number 1051305097493, when considering whether the Commissioner’s discretion under Section 99A should be exercised, it was held important that the assets of the deceased estate came directly from the assets of the deceased and that there is a definable relationship ordinarily of blood or marriage between the deceased person and the beneficiaries, and there were no other suggestions that the manner in which the trust was created was for any reason other than the ordinary and traditional kind.

Integrity Rules

It is critical to bear in mind that there are integrity rules which must be followed when seeking to preserve the excepted trust income treatment of a testamentary discretionary trust:

• The assets inherited by the testamentary discretionary trust must have been owned by the deceased person whose will established the trust at the date of their death (or as a result of reinvestment of the proceeds from those original assets).

• The trustee cannot borrow to acquire assets of the trust.

• Excepted trust income treatment will not be available if assets acquired by the trust, or activities generating the income of the trust, were not undertaken at arm’s length (e.g. assets were acquired for less than market value from a related party).

• Income is not earned by the trustee of the trust for the purpose of only generating excepted trust income.

Want More?

Ready to start helping your clients supercharge their inheritance with a testamentary trust? Get started today with The Art of Estate Planning’s Testamentary Trust Precedent Packages.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.