Trusting the Testamentary Trust Trustees

In order to access the powerful asset protection and tax advantages of a testamentary trust, there must be many people who can potentially benefit from the assets in the trust (i.e. beneficiaries) and each beneficiary’s entitlement should be at the complete discretion of the Trustee.

As a result, where a testamentary discretionary trust (referred to in this post as a testamentary trust, for ease) is established for minor children, the choice of financial controllers (i.e. the trustees and appointors) is absolutely vital to achieving the family’s legacy objectives.

In this blog post, we will focus on the common estate planning scenario where a couple is planning to establish a testamentary trust for their minor children.

Prefer to listen instead? Check out Episode #4 of The Art of Estate Planning Podcast, where we expand further on this topic of trusting the trustees

As you must be 18 years of age to take on the role of trustee and appointor for a trust, the clients must nominate people to manage the inheritance in the testamentary trust until the children reach a certain age.

Throughout this post we will refer mostly to the role of trustees, but the comments generally apply to the role of appointor as well.

The person who has control of the trust assets is the “Trustee”. The trustee is the legal holder of the assets and is responsible for the day to day management of the trust and the due administration of the trust. In a discretionary trust, the trustee has sole discretion to choose which of the beneficiaries may benefit from the income and capital of the trust.

The role of appointor (also sometimes described as ‘principal’ or ‘guardian’) is an optional role, and its powers will depend on the specific terms of the trust deed. However, the appointor will typically have power to unilaterally remove and replace the trustee, making it an incredibly powerful role. The trustee may also require the prior consent of the appointor before it can exercise some of it’s powers.

Three key issues need to be determined when preparing the testamentary trust will:

1. How to choose the appropriate people to nominate as trustee and appointor (referred to in this post as “independent trustees”)?

2. At what age should the children receive financial control of their inheritance?

3. How should control be transferred from the independent trustees to the children?

How to Choose the Independent Trustees

Documenting Instructions vs. Guiding Clients

My strong belief is that the role of an estate planning lawyer is to give clients both legal and practical guidance, to empower them to make thoughtful decisions about choosing the independent trustees rather than just documenting their instructions without stress testing the practical realities.

It is key to workshop the clients initial instructions and test their assumptions, so that a well-considered and robust strategy is ultimately implemented.

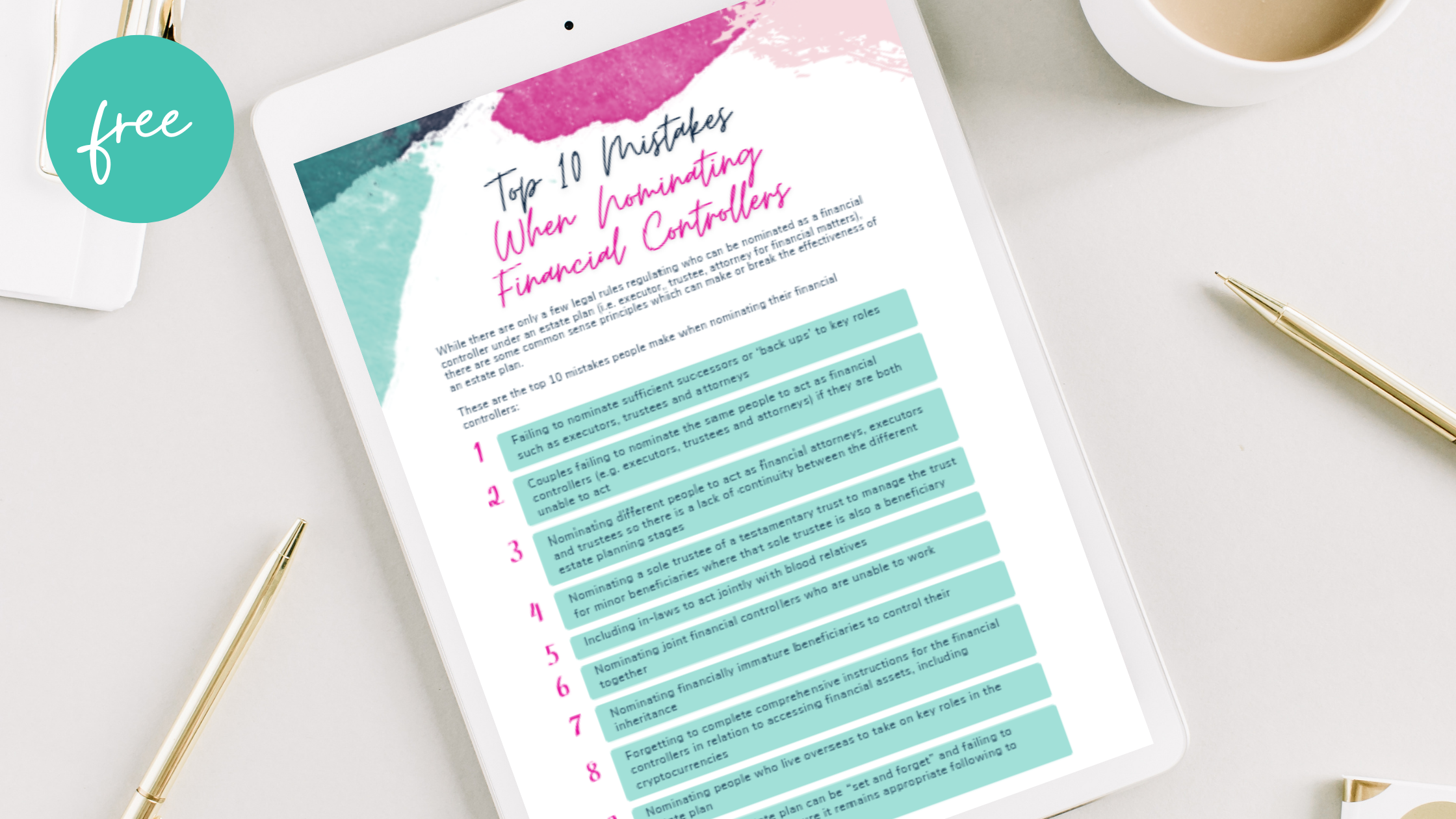

While there are some strict legal rules about structuring the trustees of a testamentary trust, here are some general rules of thumb that I have developed over my years of experience:

-

Align all financial control roles as closely as possible i.e. financial attorneys, executors and independent trustees

-

Not former bankrupt

-

Over 18

-

Maximum of 4 acting at the same time

-

If joint financial controllers, can they practically get along well enough to act together?

-

Ideally not residing overseas or in an impractical location and at least one is an Australian tax resident

-

Can they be trusted to seek appropriate external advice and follow the letter of wishes?

-

Mirror appointments for both members of a couple to ensure consistency

-

If sole controller is also a relative/potential beneficiary under the estate plan, consider nominating a second joint controller to reduce ability to abuse power

-

Consider the risk of the trust being deemed the alter ego of a beneficiary

-

Do you have at least one back up, and ideally a level two back up?

How Many Cooks in the Kitchen?

While many jurisdictions generally mandate a maximum of four trustees (although it should be noted there is usually no such limit for the role of appointor), nominating four independent trustees is probably “too many cooks in the kitchen” and could result in increased disputes, delays and unnecessary costs.

When choosing independent trustees, one strategy that I have personally seen work well is to nominate two independent trustees to act jointly.

First, two trustees share the burden and the responsibility of the role. Second, this elevates the quality of decision making as two people discuss and justify their position to each other. It also creates inherent checks and balances as a rogue or negligent trustee will be held accountable by their co-trustee.

Danger Zone: Where One of the Trustees is Included in the Beneficiary Classes of the Testamentary Trust

As explained in this blog post "What Is a Testamentary Trust?", Testamentary Discretionary Trust beneficiary classes are typically similar to the beneficiary classes of an inter vivos family trust where you would commonly expect to see the lineal descendants of the testator as the primary beneficiaries, and a broader class of secondary beneficiaries which includes the extended family such as nieces, nephews, aunts, uncles, cousins, parents, or grandparents.

If the trustee also falls within the secondary beneficiary classes, it can increase the risk that they may prefer themselves when exercising the discretionary power to distribute income or capital from the testamentary trust, over the interests of the children who are intended to be the primary beneficiaries.

In the case of Owies v JJE Nominees Pty Ltd [2022] VSCA 142, the Victorian Supreme Court of Appeal reiterated that trustees have a duty to exercise "real and genuine consideration" for all beneficiaries when distributing income of a discretionary trust. This duty applies to trustees of testamentary discretionary trusts also, and does provide a safeguard against independent trustees taking advantage of their power and excluding the intended primary beneficiaries from receiving the income and/or capital from the trust.

However, I always prefer to structure the control of a testamentary trust in such a way that there are checks and balances in place which prevent a trustee from breaching their duties, rather than having to seek a remedy for breach after the event has already occurred. If you have at least two independent trustees acting together, it can help to eliminate that risk of them preferring themselves over the intended primary beneficiaries when exercising discretion for distributions of income or capital.

Qualities We Want in Financial Controllers

I have always taken the position that provided the people you choose to be the independent trustees share the same values as you, and you trust them implicitly to act in the best interests of the children, it does not matter how sophisticated they are financially.

What is the right age for children to receive financial control of their inheritance?

I will begin by saying that the only legal requirement for a child to take control of a testamentary trust (by being appointed as the trustee and/or appointor) is that they must have legal capacity, that is, be over 18 and have legal capacity to make decisions for themselves.

Choosing the right age for a child to take over their inheritance requires a careful balancing of:

-

Testator’s values

-

Personality of the children

-

Support systems available to the children

-

Testator’s confidence in their choice of independent controllers

However, one thing that cannot be underestimated is the devastating impact on a child of losing both parents, and how this could change a child’s personality and capability to take on such an important responsibility as that of trustee.

We have all heard stories of children who are financially immature, and, upon gaining control of their inheritance, make ill-considered and short-term financial decisions that erode their inheritance. It's a classic trope.

One major benefit of a testamentary trust is that the children can benefit from the assets and income of the trust without actually having financial control of the assets in the trust. Instead, trusted independent trustees can be responsible for decisions about how to manage the investment of the inheritance, whether to keep the testamentary trust going, and how income and capital distributions are made.

Even where children have reached 18 years of age, it may be preferable to keep the independent trustees in control.

For example, consider a 25-year-old who is in a de facto relationship who wants to use their inheritance to buy a family home with their partner. If the inheritance is held in a testamentary trust, someone with a bit more wisdom who is removed from the emotion of the decision can suggest “Why don't we make the capital available for the family home purchase as a secured interest-free loan from the trust to you?”

If there is a relationship breakdown and subsequent family law property settlement, the equity that was contributed to the property purchase can be returned to the testamentary trust as a secured creditor upon the sale of the property, maintaining asset protection over that capital rather than it being paid to the ex-spouse.

This is a simple example of the benefits of choosing mature independent trustees with more life experience who can step back and consider the most appropriate way to structure the trust transactions, balancing the competing objectives of asset protection, tax flexibility, acting in the best interests of the beneficiaries and achieving the family’s commercial objectives.

Long-term Wealth Accumulation Vehicles

This isn't a short-term arrangement; it's a long-term vehicle committed to wealth accumulation over many years.

For that reason, my preferred method for children to receive control of their inheritance is by them becoming the trustees and appointors of the testamentary trust, rather than vesting the testamentary trust and distributing all the assets directly to the children outright. Vesting the trust and removing the inheritance from the trust environment automatically results in the inheritance losing the asset protection and income tax benefits which are created by the testamentary trust.

How should control be transferred from the independent trustees to the children?

When drafting the testamentary trust will, we need to discuss with the clients and take instructions on whether the children should basically take over control as soon as they turn a specified age (e.g. 18, 21, 25 or 30 are common milestones) and force a removal of those independent trustees.

Or should the independent trustees be given autonomy to decide when that transition of control happens, rather than a forced exit at a certain trigger point?

Apprenticeship Strategy

There are a myriad of ways that can be used to structure the transition of control from the independent trustees to the children, however one of my favourite approaches is the Apprenticeship Strategy.

Under the Apprenticeship Strategy, a beneficiary who has reached a specified age can be appointed as a co-trustee with the existing independent trustees so that they can undertake an “apprenticeship” of sorts and be guided by the independent trustees about how the trust operates, and their duties and responsibilities as trustee.

During the “apprenticeship”, the independent appointors remain. If the apprenticeship is not working out, then the appointors can regain control and remove the child as a co-trustee.

Instead of making the children co-trustees with the independent trustees, it is of course possible to implement a direct replacement of the independent trustees with the children, while retaining the independent appointors for a transitional period. Or alternatively, instead of a gradual and staged transfer of control, there can be an immediate exit of the independent trustees and appointors, with handover to the children.

It is possible to structure the transition of control in many different ways, and this is where your experience and guidance as the estate planning lawyer can be invaluable to help a client choose which approach would be best for their family values.

Want More?

The Art of Estate Planning also has Testamentary Trust Precedent Packages. Our TT Precedents are easy to understand and will make drafting the TT will so much easier!

Choose Your Package NowStay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.